Introduction: Understanding How Crypto Wallets Work

In the world of blockchain and decentralized finance, one of the most important tools every user needs is a crypto wallet. But what exactly does that mean? Many newcomers assume wallets store cryptocurrency directly, but in reality, that’s not how crypto wallets work. Instead, these wallets store the private keys and public keys that give users access to the assets stored on various blockchains. Without a wallet, there’s no secure way to interact with crypto networks. That’s why it’s essential to understand how crypto wallets work before storing or transferring any assets.

To put it simply: a crypto wallet is your digital identity in Web3. It allows you to send, receive, store, and interact with cryptocurrencies and decentralized applications. Understanding how to use a crypto wallet correctly is the first step toward becoming an empowered blockchain participant.

What Is a Crypto Wallet? (Explained)

A crypto wallet explained in simple terms is a tool that manages your cryptographic keys. There are two key components:

- Public Key: This is your blockchain address. You can share it with others to receive funds.

- Private Key: This is the secret code used to sign transactions. It must be kept secure at all times.

If someone has access to your private key, they can control your funds. Different blockchains implement wallets and addresses in slightly different ways—if you’re curious about how Bitcoin and Ethereum compare, check out our article “What Is The Difference Between Bitcoin And Ethereum”. If you lose it, the funds associated with that wallet are permanently inaccessible. This dual-key structure forms the basis of how crypto wallets work. Before choosing between hot or cold options, it helps to understand how crypto wallets work in different environments.

Types of Crypto Wallets

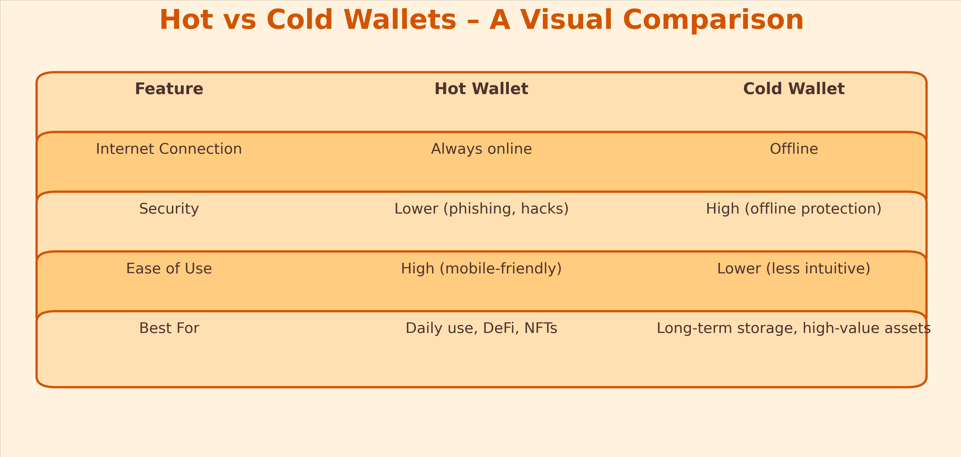

Not all wallets are created equal. The main classification is based on connectivity: cold vs hot wallet. This distinction plays a critical role in balancing convenience and security.

Hot Wallets

Hot wallets are always connected to the internet. They are ideal for frequent traders or those interacting daily with decentralized applications (dApps).

- Mobile Wallets like Trust Wallet are popular for quick access.

- Browser Extensions such as MetaMask are used for DeFi and NFTs.

- Web Wallets offered by centralized exchanges provide ease but require trust.

Cold Wallets

Cold wallets, by contrast, are kept offline. They are considered more secure and are best for long-term storage.

- Hardware Wallets like Ledger, Trezor, and Bitkey store your keys offline and require physical confirmation to authorize transactions. If you want to learn more, read: “What Is An Hardware Wallet”.

- Paper Wallets, while completely offline, are rarely used today due to risks like physical loss or damage.

Understanding the distinction between hot vs cold wallet options helps users make informed decisions based on their crypto goals.

Custodial vs. Non-Custodial Wallets

Another important category to understand is the difference between custodial and non-custodial wallets.

- Custodial Wallets: Your private keys are managed by a third-party (like a crypto exchange). These are easier for beginners but require trust in the provider.

- Non-Custodial Wallets: You are in full control of your keys and funds. This is aligned with the principle of decentralization.

If you’re looking for the best wallet for beginners, a custodial wallet might feel safer at first. However, transitioning to a non-custodial setup is highly recommended once you’re comfortable managing keys and seed phrases. It’s a critical shift in understanding how crypto wallets work in a decentralized ecosystem.

How Crypto Wallets Work: Step-by-Step

To truly grasp blockchain transactions, we need to break down how crypto wallets work behind the scenes.

Let’s break down how a wallet actually operates. The process is surprisingly elegant and grounded in cryptography.

Step 1: Key Pair Generation

When a user creates a new wallet, it automatically generates a private key. From this, a public key and wallet address are derived using mathematical algorithms. This process is secure and ensures that the private key remains secret, even though the public address is shared.

Step 2: Transaction Signing

When sending funds, the wallet uses the private key to sign the transaction. This signed transaction proves that you are the rightful owner and can authorize fund transfers. Once signed, the transaction is broadcast to the blockchain network and added to a new block. This signing process is at the heart of how crypto wallets work with smart contracts and decentralized apps.

Step 3: Blockchain Interaction

Crypto wallets query the blockchain to display your balances and transaction history. The coins themselves don’t reside in the wallet—they live on the blockchain. Your wallet simply interacts with that data using your keys.

Step 4: Seed Phrase for Recovery

Most non-custodial wallets offer a 12–24 word seed phrase during setup. This phrase is the only way to recover your wallet if your device is lost or damaged. It’s critical to keep this offline, away from cloud services or screenshots.

For a detailed tutorial, check out: “How to set up a secure crypto wallet for blockchain beginners”.

Crypto Wallet Security: How to Stay Protected

Security is one of the most important aspects of using a crypto wallet. Even the best interface is useless if your funds aren’t safe. If you value ad-free educational content like this, support our mission with a donation—every contribution helps us keep teaching crypto securely and independently.

Cold Storage Security

The safest option remains hardware wallets, which store keys offline. These devices are resistant to malware, phishing, and keyloggers. Models like Ledger and Tangem now include personal identification number (PIN), fingerprint authentication, and even Near-field communication (NFC) functionality.

Hot Wallet Best Practices

While hot wallets are more vulnerable, users can still implement layered protections:

- Enable two-factor authentication (2FA)

- Use biometric locks on mobile devices

- Whitelist withdrawal addresses

- Use strong, unique passwords

- Avoid using wallets on public or shared devices

For more information, see “How To Secure Your Ethereum Wallet: Best Practices”.

And if privacy is a major concern for your crypto strategy, you might want to explore the “Best Privacy Coins” that offer enhanced anonymity features compared to mainstream assets.

“For serious HODLers, Ledger remains the gold standard in hardware wallet protection—your keys, your coins.”

Features of Modern Wallets in 2025

Wallets today go beyond just sending and receiving crypto. As the crypto ecosystem expands, knowing how crypto wallets work becomes essential to using these features confidently. In 2025, modern wallets function as Web3 super apps, enabling a wide range of blockchain-based activities:

- NFT management and marketplace interaction

- DeFi tools like staking and yield farming

- Cross-chain swaps across Ethereum, BNB Chain, Solana, and more

- Governance voting in DAOs

Wallets like Rabby Wallet support multi-chain management in a single interface, while Tangem is innovating with NFC card wallets that don’t even need charging.

“Ready to turn insights into action? Sign up to Bybit and get up to $30,050 in bonuses, including $50 free just for starting.”

Choosing the Right Wallet for Your Needs

When deciding which wallet to use, it’s crucial to understand how crypto wallets work based on your usage and risk profile.

Selecting a wallet is a personal decision based on your usage, technical skill, and risk profile. Here are a few example use cases:

- Daily DeFi & NFTs: Use MetaMask or Trust Wallet. They’re hot wallets with wide dApp support.

- Cold long-term storage: Use Ledger, Bitkey, or Trezor. These offer maximum protection.

- Mobile beginners: Start with Coinbase Wallet or Binance Wallet, then move to non-custodial later.

Ultimately, the best wallet for beginners is one that balances safety and usability while teaching users the value of key ownership.

To go further, explore our complete guide on how to earn crypto safely using wallets, staking, and blockchain tools.

Summary Table: Wallet Comparison

| Wallet Type | Connectivity | Custodial | Best Use Case |

|---|---|---|---|

| MetaMask / Trust | Hot | No | Daily DeFi, NFTs, browser access |

| Coinbase Wallet | Hot | Yes | Beginners who want convenience |

| Ledger / Trezor | Cold | No | Long-term, high-value storage |

| Tangem / Bitkey | Cold | No | Secure storage + NFC features |

| Paper Wallet | Cold | No | Offline backup (not beginner-safe) |

Each wallet type shows a different way in which crypto wallets work, from convenience-focused tools to security-first cold storage.

The smartest strategy is to use a hybrid approach: a hot wallet for daily use and a cold wallet for savings.

The Future of Crypto Wallets

As blockchain adoption grows, so too does the importance of wallets. We expect to see:

- Embedded wallets inside Web3 apps and browsers

- More biometric security and multi-device syncing

- AI-driven threat detection for suspicious behavior

- Expansion of interoperability between chains

Wallets will become more user-friendly, multi-functional, and secure—removing many of the technical barriers that once kept newcomers away. These innovations will redefine how crypto wallets work for both beginners and advanced users.

Conclusion

Understanding how crypto wallets work is critical for anyone entering the blockchain space. Truly understanding how crypto wallets work is critical for anyone entering the blockchain space. From public keys vs private keys to the difference between hot vs cold wallet, this foundational knowledge empowers users to protect their assets and engage confidently with Web3 tools. By now, you should have a clear understanding of how crypto wallets work and why they are essential to blockchain usage.

Whether you’re a beginner setting up your first mobile wallet or a seasoned investor securing your portfolio with hardware storage, the principles remain the same: control your keys, manage your risk, and stay informed.

Want to receive updated guides and tips? Join our newsletter and unlock 70+ free PDFs to deepen your crypto knowledge.

Learning how to use a crypto wallet is your first step toward digital sovereignty. Choose wisely, secure responsibly, and keep building.

What happens if I lose my seed phrase?

Without it, recovering your private keys is virtually impossible—treat it like vault keys.

Can I recover my wallet if my device is damaged?

Yes—restore it using your seed phrase on a compatible wallet.

“Guess what? When you click and buy via our links, you’re not just enhancing your experience—you‘re also supporting our content creation for free, so we can keep sharing useful blockchain insights. It‘s a pump for both of us!”

— Sofi