What Is Token Vesting?

Token vesting is a fundamental concept in blockchain projects and crypto startups. But what is token vesting, exactly? It refers to a structured process in which tokens are locked and gradually released over a period of time based on predefined conditions. This prevents team members, advisors, and investors from selling their tokens immediately after receiving them, which can damage the project’s market reputation and price stability.

Just like traditional startup equity that vests over time to retain employees, token vesting in crypto is designed to encourage long-term commitment and protect tokenomics. Whether you’re a builder, investor, or community contributor, understanding the mechanics of a vesting schedule crypto is essential to avoid being caught off-guard by sudden token unlocks or poorly timed cliffs.

Why Token Vesting Matters in Crypto Projects

Aligning Long-Term Incentives

The core reason for implementing token vesting is to align incentives between the project and its contributors. By locking tokens and releasing them progressively, stakeholders remain invested in the project’s success. Team members are more likely to stay active, and advisors are less tempted to exit early after token distribution.

Preventing Token Dumps and Price Volatility

When large quantities of tokens are unlocked at once, it can create selling pressure that causes the token’s price to crash. This is especially true for early-stage projects or those with weak community trust. Token vesting mitigates this by breaking down allocations into manageable, periodic token unlocks, ensuring smoother market impact and a predictable circulating supply.

Building Trust With Investors

Well-structured and transparent vesting schedules are signs of a mature and professional project. When investors see that founders and insiders are subject to the same or even stricter vesting terms, it signals confidence and alignment with long-term goals. This transparency plays a critical role in the due diligence process.

Core Components of a Token Vesting Structure

Vesting Schedule

A vesting schedule defines the timeline for releasing tokens to a participant. It often starts with a cliff vesting period, followed by a continuous release of tokens over a specified timeframe. The vesting schedule can be monthly, quarterly, or milestone-based, depending on the project’s goals.

Cliff Vesting in Crypto

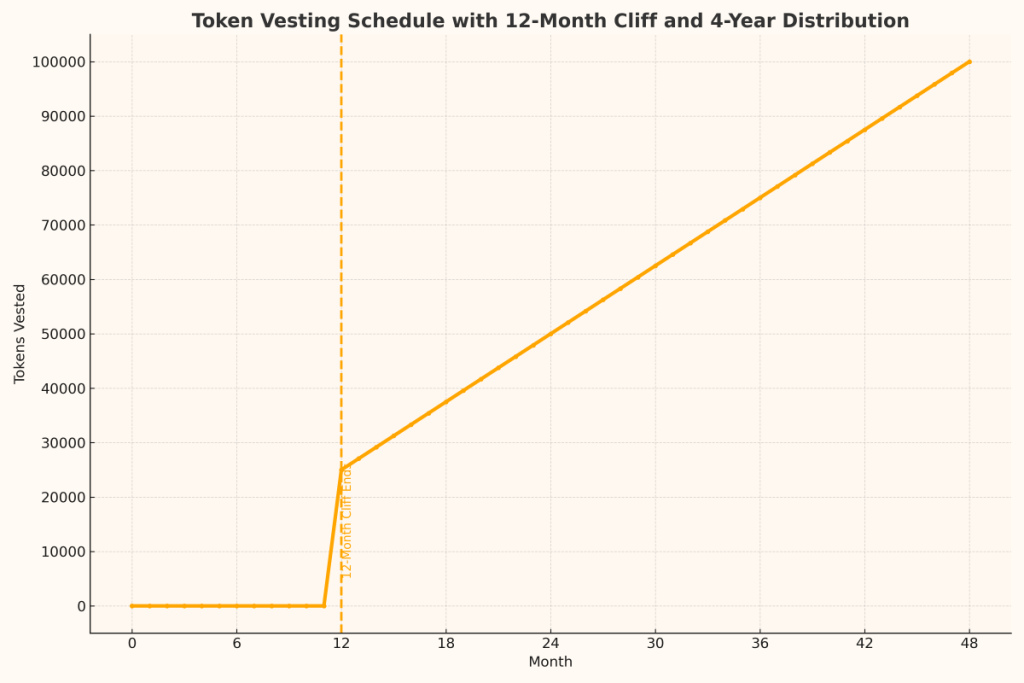

Cliff vesting in crypto means that no tokens are released until a specific date, called the cliff. It functions as a probation period. For example, a 12-month cliff means a contributor won’t receive any tokens until one year has passed. If they leave before that, they get nothing. This discourages short-term participation and ensures contributors are genuinely committed.

Linear Vesting

In linear vesting, tokens are distributed evenly over time. For instance, if someone is allocated 100,000 tokens over four years with monthly vesting, they would receive 1/48th each month. This model is predictable and easy to track.

Milestone-Based Vesting

Instead of time, milestone vesting releases tokens when specific deliverables or objectives are met. This is common for consultants or tech contributors, especially in DAOs. It ensures that value is delivered before tokens are awarded.

Accelerated Vesting

In the event of major events like acquisitions or token mergers, accelerated vesting may be triggered. This allows team members or advisors to receive all remaining tokens immediately, even if the original schedule wasn’t completed.

Who Benefits From Token Vesting?

Founders and Core Teams

Founders typically receive token allocations with vesting periods of 2–4 years. This helps maintain strategic focus and commitment across the project lifecycle (if you are wondering ”What is project lifecycle?” just check out this article.)

Advisors and Consultants

Advisors usually receive smaller allocations, with shorter vesting periods such as 6–18 months. The goal is to ensure advisors provide continued value over time, not just at the moment of launch.

Early Investors

While not always subject to vesting, early investors in private or seed rounds may agree to token lockups to avoid massive dumps on day one of public trading.

Community Contributors

Some projects use token vesting for community rewards or bounty programs. Contributors who help with development, translation, or promotion might receive tokens that unlock over months instead of instantly.

For more real-world strategies to earn crypto through blockchain contribution, staking, or content creation, explore our dedicated guide.

How Token Vesting Works: A Step-by-Step Process

- Identify vesting participants (founders, advisors, investors).

- Define allocation amounts and total vesting duration.

- Set the cliff period (e.g., 6 or 12 months).

- Choose a vesting model (linear, milestone, etc.).

- Deploy smart contracts or draft legal agreements.

- Initiate lock-up based on token generation event (TGE).

- Monitor ongoing token unlocks and release events.

For example, in a 4-year linear vesting schedule with a 12-month cliff, a team member will receive 0 tokens for the first 12 months. At month 12, they get 25% of the total allocation. The remaining 75% is then distributed monthly over the next 36 months. By month 48, all tokens are fully vested.

Technical Implementation: Smart Contracts and Legal Structures

Smart Contract-Based Vesting

Most modern crypto projects implement token vesting through smart contracts. These are immutable and transparent, providing publicly verifiable schedules on-chain. Tools like OpenZeppelin’s VestingWallet or custom-built contracts on Ethereum or other EVM-compatible chains are often used.

Off-Chain Legal Agreements

Some projects, especially those in regulated environments, manage vesting through legal frameworks. In this case, tokens might be held by a third party or escrow account, with formal agreements controlling the release based on milestone completion or time-based events.

“For serious HODLers, Ledger remains the gold standard in hardware wallet protection—your keys, your coins.”

Token Vesting Risks and Best Practices

Smart Contract Bugs

Errors in vesting contract code can cause premature token releases or lock tokens indefinitely. Security audits from trusted firms are essential before deployment.

Poor Vesting Alignment

Releasing all advisor tokens in the same month can lead to coordinated selling and price instability. Spacing out vesting schedules minimizes this risk.

Lack of Transparency

Vesting terms should be clearly documented in whitepapers, public dashboards, and tokenomics reports. If users can’t access or verify vesting data, trust erodes quickly.

Under or Over-Vesting

Too-fast vesting causes token inflation; too-slow vesting can demotivate contributors. The ideal schedule balances ecosystem growth with participant motivation.

Real-World Examples of Token Vesting

Post-ICO Lockups

Many Initial Coin Offering (ICO) apply token vesting to 20–30% of the total supply for team members, using 4-year vesting with 1-year cliffs to signal long-term vision.

DAO Contributor Models

In DAOs, contributors often receive tokens through proposal-based vesting, where the community votes on milestones and reward structures.

Token Pools for New Hires

Projects like Uniswap and OpenSea use token pools for employee incentives. These tokens are distributed based on onboarding schedules with individual vesting terms.

Tokenomics and Vesting Synergy

Unlock Forecasting

Tokenomics: The Science Behind Cryptocurrency Valuation often includes vesting models to predict supply inflation. Projects use dashboards to visualize token unlocks and their impact on circulating supply.

Price Impact Analysis

If a large unlock event is approaching, savvy investors may anticipate market dips. By studying vesting charts, token holders can prepare exit or buyback strategies.

If you appreciate educational content like this, consider making a donation to help us keep publishing in-depth crypto insights—free and ad-free.

“Ready to turn insights into action? Sign up to Bybit and get up to $30,050 in bonuses, including $50 free just for starting.”

Key Questions to Ask Before Trusting a Vesting Plan

- Who is receiving tokens under vesting?

- What is the cliff duration?

- Is the vesting model linear, milestone-based, or hybrid?

- Are there any acceleration triggers?

- Is the vesting public and verifiable?

- Is the smart contract code audited and accessible?

- Is the project listed under Must-Know Blockchain Protocols For Developers or similar resources?

Conclusion: Why Token Vesting Is Non-Negotiable

In crypto, where hype often exceeds substance, token vesting is a powerful tool to build accountability, align interests, and ensure sustainability. It is more than a legal or technical requirement — it’s a philosophical commitment to long-term growth. When implemented with transparency and logic, vesting becomes a foundation of trust that elevates both token value and community loyalty.

Every project claiming legitimacy should clearly define its vesting schedule crypto model, with public documentation, unlock charts, and secure smart contracts. For investors and contributors alike, analyzing vesting terms isn’t optional — it’s essential due diligence. Want to learn more about crypto tokenomics and security models? Subscribe to our newsletter and unlock 70+ expert PDF guides, updated weekly. Understanding what is token vesting and how it operates will help you make smarter decisions, whether you’re investing in a token, joining a DAO, or building a protocol from scratch.

What is a vesting cliff?

A vesting cliff is the initial period (often 6–12 months) during which no tokens vest. It protects against early departures by ensuring recipients remain involved before unlocking tokens.

How does milestone vesting differ from linear vesting?

Linear vesting releases tokens in equal increments over time, while milestone vesting releases tokens only after specified goals are reached (e.g., product launch or audit completion).

Can vesting schedules be changed?

Only if predefined in the smart contract or agreed upon in legal documentation. Changes often require stakeholder approval or DAO votes and should be transparent.

Why do vesting schedules matter for token price?

Large token unlocks can flood the market, potentially driving prices down. Understanding vesting release dates helps forecast and manage risk exposure.

What’s accelerated vesting?

Accelerated vesting allows token releases to happen faster due to specific events—like company acquisition, team buyout, or major project milestones—protecting recipients from long lockups in uncertain scenarios.

“Guess what? When you click and buy via our links, you’re not just enhancing your experience—you‘re also supporting our content creation for free, so we can keep sharing useful blockchain insights. It‘s a pump for both of us!”

— Sofi