Understanding Crypto Regulations 2025

The world of cryptocurrency is rapidly evolving, and crypto regulations in 2025 have become a key turning point in shaping its regulatory landscape. Countries around the world are introducing clear rules to protect consumers, prevent crime, and support innovation. As a result, these efforts aim to build trust in the crypto space and encourage mainstream adoption. As the value and complexity of digital assets continue to grow, regulations ensure a level playing field for both individuals and institutions.

Whether you’re a beginner curious about blockchain or a company launching a new token, understanding the direction of crypto regulations 2025 is essential. By following these frameworks, market participants can minimize legal risk, improve reputation, and open doors to long-term growth in a competitive global market. Staying informed about crypto regulations 2025 is not just a legal necessity—it’s a competitive advantage for early adopters.

Why Crypto Regulations 2025 Matter for Investors

Crypto regulations 2025 are important for four main reasons. First, they protect users from scams and hacking by requiring platforms to follow security rules. Second, they make crypto markets more stable, which helps big investors feel confident. Third, they stop illegal activities like money laundering. Finally, clear rules help new ideas grow safely.

For serious HODLers, Ledger remains the gold standard in hardware wallet protection—your keys, your coins.

Consequently, these laws and guidelines bring structure to a space that has long been seen as unpredictable. While some fear that regulation could limit freedom, the reality is that smart regulation enables innovation. Furthermore, it helps create standards, enforce best practices, and support long-term adoption. As more people join the crypto world, having clear protections in place will be key to ensuring fairness, safety, and trust.

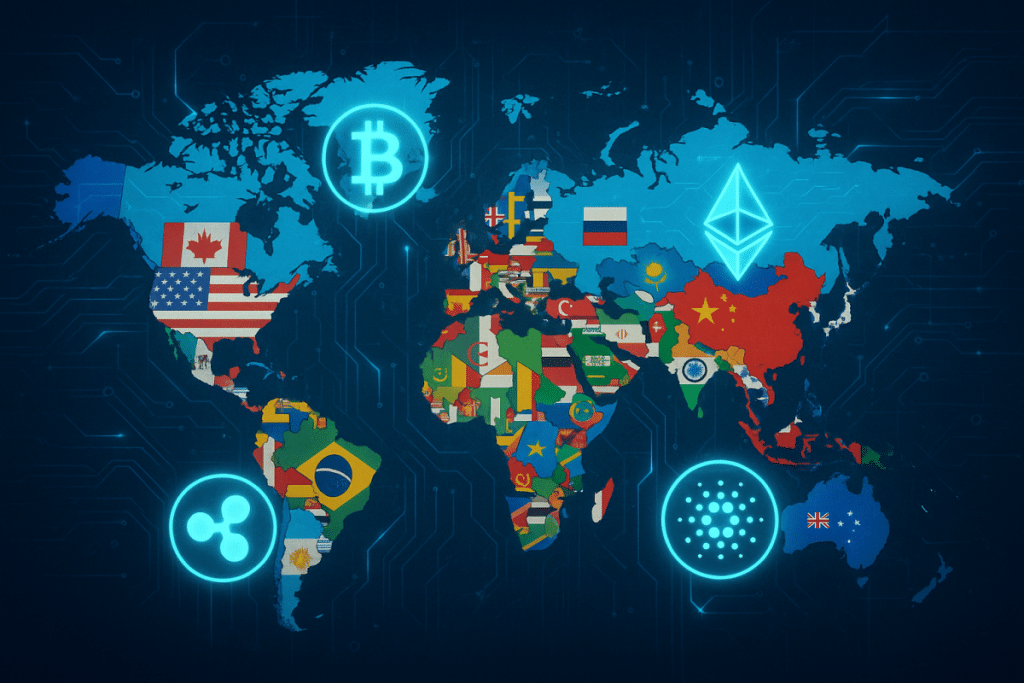

International Regulatory Frameworks

Across the globe, key organizations and countries are shaping the rules for cryptocurrency. One of the biggest players is the Financial Action Task Force (FATF), which updated its Travel Rule in 2025. This rule now applies to decentralized platforms and requires crypto companies to collect and share information about people sending and receiving funds. In practice, the goal is to track the origin and destination of crypto payments across borders. These updates are part of the global effort to strengthen crypto regulations 2025 and improve transaction traceability.

In Europe, the MiCa Regulation 2025 improves on the original rules set in 2024. It introduces clear guidelines for stablecoins, new licensing rules for DeFi platforms, and standard disclosures for investors. These cryptocurrency laws Europe-wide make it easier for crypto companies to operate legally across all EU countries. By standardizing rules across member states, MiCa Regulation 2025 reduces compliance complexity and gives investors confidence.

In the United States, the new crypto regulations USA provide clarity on what types of tokens are securities and which are commodities. The SEC now oversees token sales and disclosure, while the CFTC manages crypto futures and derivatives. As a result, these changes help companies understand how to launch legal projects.

Additionally, U.S. regulators have created sandboxes and pilot programs to support innovation without exposing the public to unnecessary risk.

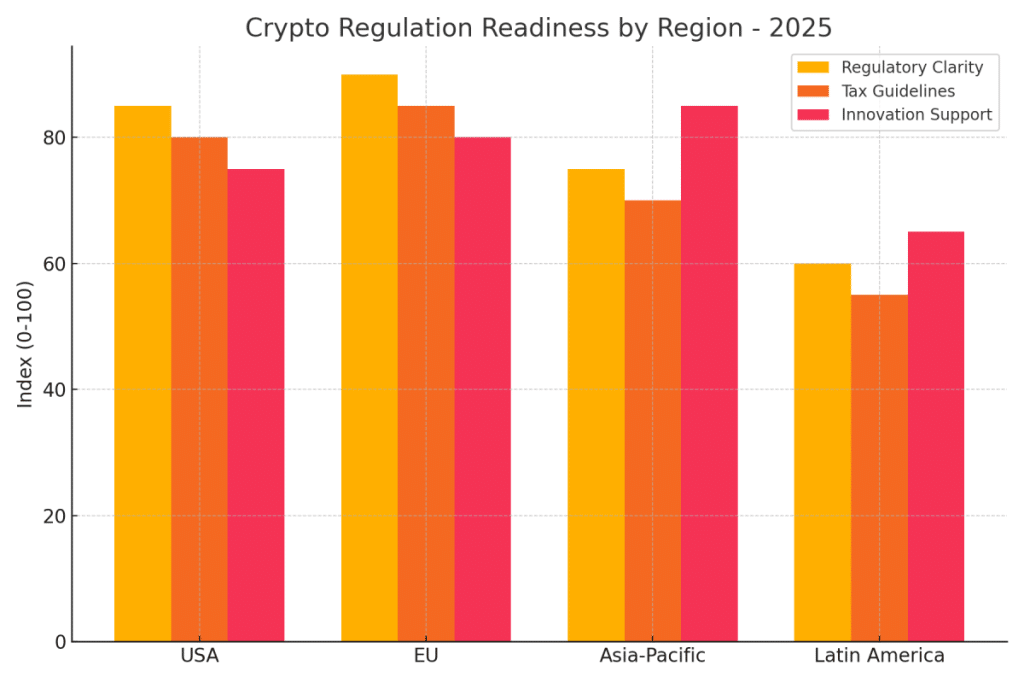

Regional Insights: What’s Changing Around the World

United States

The new crypto regulations USA have introduced quarterly audits for stablecoin providers. These audits ensure that tokens are properly backed. Many tokens from past ICOs are now treated as securities and must be registered. States like Wyoming support blockchain innovation, while programs like New York’s Green Crypto Grant promote eco-friendly mining.

The U.S. has also created clear disclosure rules for exchanges and wallets, requiring detailed user agreements and explanations of risk. In turn, this transparency helps users make informed decisions and increases accountability. Additionally, the Internal Revenue Service (IRS) has released updated tax guidelines to help individuals and businesses report crypto income accurately.

European Union

In the EU, cryptocurrency laws Europe now require platforms to check unhosted wallets and verify user identities. The new DeFi passport allows licensed DeFi projects to operate across all member states. MiCa Regulation 2025 has made it easier for investors to understand risks before buying tokens.

By reducing regulatory fragmentation, MiCa 2 makes the EU a more attractive market for innovation. The MiCa framework is one of the most comprehensive examples of crypto regulations 2025 in action.

Exchanges that meet these new standards benefit from streamlined licensing, cross-border access, and increased credibility with users and institutions. EU member states are also launching educational programs to help consumers understand their rights and responsibilities. For a deeper dive into how taxes are applied to crypto transactions across the EU, check out our full article: “Crypto Taxation in Europe 2025: What Investors Need to Know”.

Asia-Pacific

Japan has strict rules for algorithmic stablecoins, including local asset backing and third-party audits. Singapore has expanded its payments law to include digital real estate and NFTs. Meanwhile, India is finalizing a bill to treat crypto as taxable property and charge a 20% capital gains tax.

In Australia and South Korea, governments are testing blockchain ID systems and national digital wallets. These tools can connect directly with exchanges and DeFi apps, allowing seamless KYC and AML integration. Asia-Pacific is quickly becoming a leader in combining innovation with responsible regulation. These proactive policies make the region a central player in shaping effective crypto regulations 2025 that support both security and scalability. If you’re curious about the role of privacy coins in a regulated world, don’t miss “Privacy Coins Vs. Bitcoin: What Are The Key Differences?”.

Latin America

Brazil is introducing a digital asset law that requires wallet services to carry insurance. Additionally, Argentina now taxes crypto-to-crypto trades. Furthermore, El Salvador is focusing on AML compliance to attract global banks and investors.

In addition, Colombia and Chile are working on pilot programs for tokenized bonds. These projects show how crypto can improve financial transparency and reduce costs in public finance. With the rise of crypto regulations 2025, the region is positioning itself as a model for combining technology with policy reform.

Latin America is demonstrating how smart regulation can support economic growth and financial inclusion.

Who Is Affected by Crypto Regulations 2025?

Crypto Regulations 2025: What Individual Investors Need to Know

For everyday users, crypto regulations 2025 bring more safety. Platforms must show proof of reserves and follow strict rules. However, access to risky or untested projects may be limited. Investors are encouraged to use licensed platforms and track their taxes carefully.

The goal is to ensure that users know what they are buying, understand the risks, and can recover losses in case of fraud. Insurance for custodial wallets, detailed whitepapers, and real-time price reporting are becoming standard features. In some countries, users also benefit from dispute resolution systems supported by financial regulators. If you believe you’ve encountered a suspicious platform, follow our practical guide: “Steps To Report A Cryptocurrency Scam”.

Institutions

Banks, funds, and large investors benefit from clear rules. New SEC approved crypto ETFs, insured custody services, and legal on-chain settlements are becoming common. This helps traditional finance connect with digital assets. With crypto regulations 2025 providing greater legal clarity, traditional institutions can now integrate digital assets more confidently.

Regulatory clarity gives institutions the confidence to offer new products, invest in crypto startups, and expand into Web3 markets. In addition, large firms are building partnerships with blockchain infrastructure providers, contributing to the development of more secure and scalable financial systems.

Crypto Businesses

Exchanges, wallets, and DeFi platforms must now meet higher standards. They need to get licensed, follow KYC/AML rules, and report on operations. Companies that don’t comply risk being removed from listings or blocked by regulators.

Compliant companies gain a competitive advantage. Those aligned with crypto regulations 2025 are more likely to build lasting trust and attract global partnerships. Therefore, they are more likely to attract partnerships, institutional users, and long-term investors. As a result, many startups now hire legal advisors early in their product design process to ensure every feature meets global regulatory expectations.

Best Practices to Stay Compliant With Crypto Regulations 2025

For Companies

- Build a legal and compliance team

- Follow global standards like ISO 20022

- Join official test environments (regulatory sandboxes)

- Moreover, provide clear information to users

- Cooperate with regulators and keep systems transparent

- Maintain open communication with legal experts and compliance officers

- Regularly audit security systems and smart contracts

For Investors

- Choose platforms with proper licenses (SEC, MiCa, MAS)

- Use wallets and exchanges with proof-of-reserve

- File taxes on every trade, even crypto-to-crypto

- Store long-term assets in hardware wallets

- Read token details carefully before investing

- Follow local laws and tax updates

- Use crypto tax software that supports your country

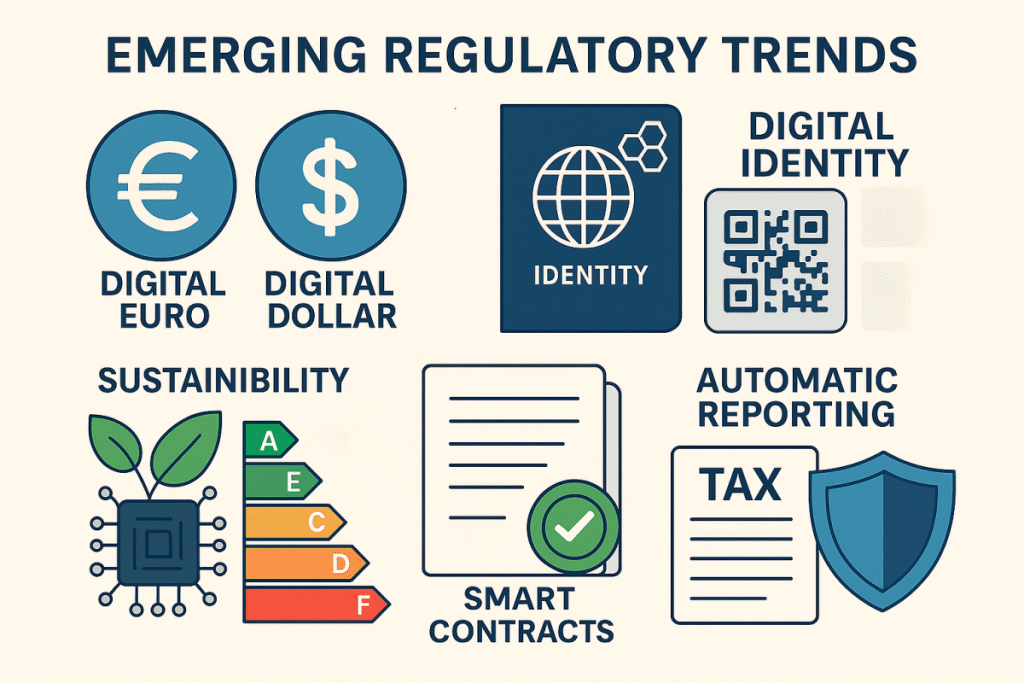

New Trends in Crypto Regulations

Crypto regulations 2025 are adapting to future demands by introducing smarter and more structured approaches to compliance and innovation. Here are the key areas of evolution:

Digital Currency and Identity Innovations

- Central Bank Digital Currencies (CBDCs): Many countries are testing digital currencies that work both online and offline, and support cross-border payments. To understand how national banks are developing digital alternatives to traditional money, explore “The Emergence Of Central Bank Digital Currencies (CBDCs)”.

- Digital IDs: At the same time, governments are piloting blockchain-based identity systems, enabling secure wallet access and compliance with KYC protocols. These innovations are increasingly shaped by evolving crypto regulations 2025, which prioritize both user privacy and verifiable compliance.

- Web3 Safety Rules: NFT platforms now face stricter guidelines to protect minors and ensure transparency in royalties.

Compliance, Sustainability, and Licensing

- Eco Standards: Blockchain projects must now report their energy usage and may be required to adopt carbon offset solutions.

- Smart Contract Auditing: As such, new policies mandate independent reviews of smart contracts before deployment to ensure security.

- Automated Tax Reporting: Regulatory bodies and exchanges are integrating to simplify tax compliance through automatic transaction reporting. This is part of a larger shift driven by crypto regulations 2025, aiming to reduce manual errors and increase global tax transparency.

- Cross-border Licensing: Countries are forming agreements to recognize crypto licenses across jurisdictions, making global expansion more efficient.

Overall, these trends reflect a shift toward cooperation, transparency, and long-term growth. The evolution of crypto regulations 2025 supports this shift by creating an environment where innovation and compliance go hand in hand.

Instead of blocking innovation, regulations are enabling a safer, more scalable crypto ecosystem for users and businesses alike.ation. Rather than limiting growth, they aim to make the ecosystem more secure, transparent, and sustainable.

What are the major crypto regulations in 2025?

Key rules include the FATF’s Travel Rule, MiCa Regulation 2025 in Europe, and new SEC and CFTC frameworks in the USA.

How do new regulations affect crypto users?

Users get more protection and better tools, but they may have fewer risky options.

How are taxes managed now?

Most countries require tax reports on every crypto trade. Software tools help track and report automatically.

Is DeFi still allowed in 2025?

Yes, but only licensed DeFi platforms that use KYC/AML tools can operate legally across borders.

What should companies do to stay compliant?

They should get licenses, follow AML rules, use clear disclosures, and work closely with legal experts.

“Guess what? When you click and buy via our links, you’re not just enhancing your experience—you‘re also supporting our content creation for free, so we can keep sharing useful blockchain insights. It‘s a pump for both of us!”

— Sofi